A Rightward Shift in the Aggregate Demand Curve Can Be Caused by an Increase in:

Chapter 24. The Aggregate Demand/Amass Supply Model

24.four Shifts in Aggregate Need

Learning Objectives

By the end of this section, you will be able to:

- Explicate how imports influence amass need

- Identify ways in which business confidence and consumer conviction tin can affect aggregate need

- Explain how government policy tin change amass need

- Evaluate why economists disagree on the topic of tax cuts

Every bit mentioned previously, the components of aggregate demand are consumption spending (C), investment spending (I), government spending (Thousand), and spending on exports (X) minus imports (M). (Read the following Clear Information technology Up feature for explanation of why imports are subtracted from exports and what this means for aggregate need.) A shift of the AD bend to the right means that at least one of these components increased so that a greater amount of total spending would occur at every toll level. A shift of the Advertizing curve to the left ways that at least one of these components decreased then that a bottom amount of full spending would occur at every toll level. The Keynesian Perspective will discuss the components of aggregate demand and the factors that touch them. Here, the word will sketch two broad categories that could crusade AD curves to shift: changes in the behavior of consumers or firms and changes in government revenue enhancement or spending policy.

Exercise imports diminish aggregate demand?

We take seen that the formula for amass demand is AD = C + I + Thou + X – K, where Yard is the total value of imported goods. Why is there a minus sign in forepart of imports? Does this mean that more imports will event in a lower level of aggregate demand?

When an American buys a strange product, for instance, it gets counted forth with all the other consumption. And then the income generated does not go to American producers, but rather to producers in another country; it would be wrong to count this as role of domestic need. Therefore, imports added in consumption are subtracted back out in the M term of the equation.

Considering of the fashion in which the demand equation is written, information technology is easy to make the mistake of thinking that imports are bad for the economy. Only keep in listen that every negative number in the M term has a corresponding positive number in the C or I or G term, and they always cancel out.

How Changes by Consumers and Firms Can Impact Advertizement

When consumers feel more than confident almost the hereafter of the economy, they tend to consume more. If business confidence is loftier, and then firms tend to spend more on investment, believing that the time to come payoff from that investment volition be substantial. Conversely, if consumer or business confidence drops, then consumption and investment spending decline.

The Academy of Michigan publishes a survey of consumer conviction and constructs an alphabetize of consumer confidence each month. The survey results are then reported at http://www.sca.isr.umich.edu, which suspension down the change in consumer confidence among different income levels. Co-ordinate to that alphabetize, consumer conviction averaged around ninety prior to the Bang-up Recession, and then it fell to beneath threescore in late 2008, which was the lowest information technology had been since 1980. Since then, confidence has climbed from a 2022 low of 55.8 dorsum to a level in the depression 80s, which is considered shut to beingness considered a good for you state.

Ane measure of business confidence is published by the OECD: the "business organization trend surveys". Business concern stance survey data are nerveless for 21 countries on future selling prices and employment, among other elements of the business climate. Later on sharply declining during the Great Recession, the measure has risen above zippo again and is back to long-term averages (the indicator dips below zero when business outlook is weaker than usual). Of class, either of these survey measures is non very precise. They can nonetheless, suggest when confidence is ascension or falling, as well every bit when it is relatively loftier or low compared to the by.

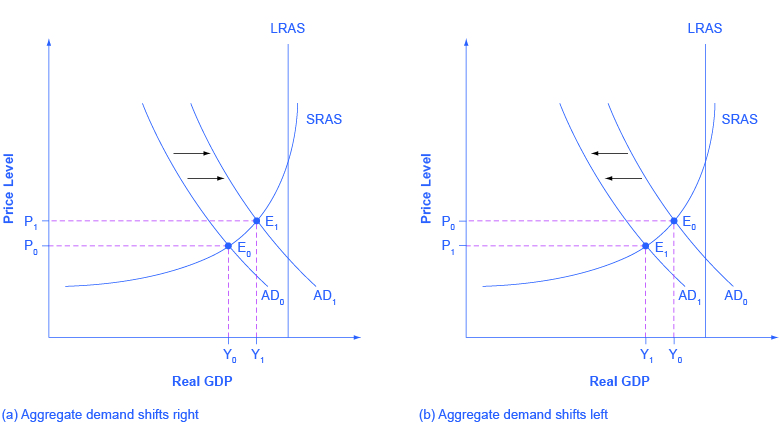

Considering a rise in confidence is associated with higher consumption and investment need, information technology volition pb to an outward shift in the AD bend, and a move of the equilibrium, from E0 to Eastward1, to a college quantity of output and a higher toll level, as shown in Figure 1 (a).

Consumer and business concern confidence frequently reflect macroeconomic realities; for instance, conviction is usually high when the economy is growing briskly and depression during a recession. Nonetheless, economical confidence can sometimes rise or fall for reasons that exercise non have a close connection to the firsthand economic system, similar a adventure of state of war, election results, foreign policy events, or a pessimistic prediction virtually the future by a prominent public figure. U.Southward. presidents, for example, must exist careful in their public pronouncements about the economy. If they offer economic pessimism, they take a chance provoking a decline in confidence that reduces consumption and investment and shifts Advert to the left, and in a self-fulfilling prophecy, contributes to causing the recession that the president warned confronting in the first place. A shift of AD to the left, and the corresponding movement of the equilibrium, from E0 to Eane, to a lower quantity of output and a lower price level, is shown in Effigy 1 (b).

How Government Macroeconomic Policy Choices Tin can Shift Advertisement

Government spending is one component of Advertizing. Thus, college regime spending will cause AD to shift to the correct, every bit in Figure 1 (a), while lower authorities spending will cause Advertisement to shift to the left, every bit in Figure 1 (b). For case, in the U.s.a., government spending declined by three.ii% of GDP during the 1990s, from 21% of Gdp in 1991, and to 17.viii% of Gdp in 1998. However, from 2005 to 2009, the peak of the Great Recession, government spending increased from 19% of Gdp to 21.four% of Gdp. If changes of a few percentage points of GDP seem small to you, remember that since Gdp was about $fourteen.4 trillion in 2009, a seemingly pocket-size change of 2% of GDP is equal to close to $300 billion.

Tax policy can affect consumption and investment spending, likewise. Tax cuts for individuals volition tend to increase consumption demand, while tax increases will tend to diminish it. Taxation policy tin also pump upwards investment demand by offering lower tax rates for corporations or tax reductions that benefit specific kinds of investment. Shifting C or I will shift the AD curve as a whole.

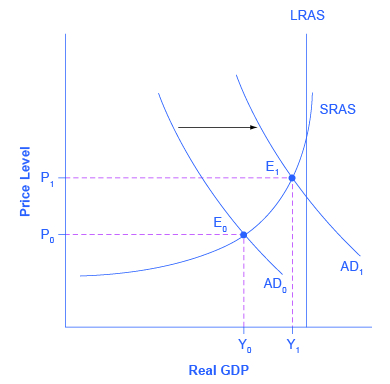

During a recession, when unemployment is high and many businesses are suffering low profits or fifty-fifty losses, the U.S. Congress often passes tax cuts. During the recession of 2001, for example, a tax cutting was enacted into constabulary. At such times, the political rhetoric often focuses on how people going through hard times need relief from taxes. The aggregate supply and amass need framework, however, offers a complementary rationale, as illustrated in Figure 2. The original equilibrium during a recession is at point E0, relatively far from the full employment level of output. The tax cut, past increasing consumption, shifts the Advertizement curve to the right. At the new equilibrium (Eone), real Gross domestic product rises and unemployment falls and, because in this diagram the economy has not yet reached its potential or full employment level of Gdp, any rise in the price level remains muted. Read the following Clear It Up feature to consider the question of whether economists favor tax cuts or oppose them.

Do economists favor tax cuts or oppose them?

One of the most key divisions in American politics over the final few decades has been betwixt those who believe that the government should cut taxes substantially and those who disagree. Ronald Reagan rode into the presidency in 1980 partly because of his hope, soon carried out, to enact a substantial tax cut. George Bush lost his bid for reelection against Bill Clinton in 1992 partly because he had broken his 1988 promise: "Read my lips! No new taxes!" In the 2000 presidential election, both George West. Bush-league and Al Gore advocated substantial tax cuts and Bush succeeded in pushing a package of revenue enhancement cuts through Congress early in 2001. Disputes over tax cuts often ignite at the country and local level as well.

What side are economists on? Practice they support broad tax cuts or oppose them? The respond, unsatisfying to zealots on both sides, is that information technology depends. One issue is whether the taxation cuts are accompanied by as big government spending cuts. Economists differ, every bit does any wide cross-section of the public, on how big regime spending should exist and what programs might exist cut dorsum. A 2d issue, more relevant to the discussion in this chapter, concerns how shut the economy is to the full employment level of output. In a recession, when the intersection of the AD and Every bit curves is far beneath the total employment level, taxation cuts can make sense every bit a style of shifting Advert to the right. All the same, when the economy is already doing extremely well, tax cuts may shift AD so far to the right as to generate inflationary pressures, with little gain to Gdp.

With the AD/Every bit framework in mind, many economists might readily believe that the Reagan tax cuts of 1981, which took effect just after two serious recessions, were benign economic policy. Similarly, the Bush-league taxation cuts of 2001 and the Obama tax cuts of 2009 were enacted during recessions. Withal, some of the same economists who favor revenue enhancement cuts in fourth dimension of recession would be much more dubious nearly identical tax cuts at a time the economy is performing well and cyclical unemployment is low.

The utilize of government spending and tax cuts can be a useful tool to bear upon aggregate demand and it will exist discussed in greater detail in the Government Budgets and Fiscal Policy chapter and The Impacts of Regime Borrowing. Other policy tools can shift the amass demand curve as well. For example, as discussed in the Monetary Policy and Bank Regulation chapter, the Federal Reserve tin affect interest rates and the availability of credit. Higher involvement rates tend to discourage borrowing and thus reduce both household spending on big-ticket items like houses and cars and investment spending by business. Conversely, lower interest rates volition stimulate consumption and investment demand. Interest rates can likewise affect substitution rates, which in turn will take effects on the consign and import components of aggregate demand.

Spelling out the details of these alternative policies and how they bear on the components of aggregate need can wait for The Keynesian Perspective affiliate. Here, the key lesson is that a shift of the aggregate need curve to the right leads to a greater real GDP and to upward pressure on the toll level. Conversely, a shift of aggregate demand to the left leads to a lower real Gross domestic product and a lower toll level. Whether these changes in output and price level are relatively large or relatively small, and how the change in equilibrium relates to potential GDP, depends on whether the shift in the AD bend is happening in the relatively apartment or relatively steep portion of the AS curve.

Key Concepts and Summary

The AD curve will shift out as the components of aggregate demand—C, I, 1000, and Ten–M—ascension. It volition shift back to the left as these components autumn. These factors can change because of different personal choices, like those resulting from consumer or business conviction, or from policy choices similar changes in government spending and taxes. If the AD curve shifts to the right, then the equilibrium quantity of output and the toll level will rise. If the AD curve shifts to the left, so the equilibrium quantity of output and the price level will fall. Whether equilibrium output changes relatively more than the toll level or whether the price level changes relatively more than output is adamant by where the AD curve intersects with the As curve.

The AD/AS diagram superficially resembles the microeconomic supply and need diagram on the surface, but in reality, what is on the horizontal and vertical axes and the underlying economic reasons for the shapes of the curves are very dissimilar. Long-term economic growth is illustrated in the AD/As framework by a gradual shift of the amass supply bend to the right. A recession is illustrated when the intersection of Advertisement and Every bit is substantially below potential GDP, while an expanding economy is illustrated when the intersection of AS and AD is near potential Gross domestic product.

Self-Cheque Questions

- How would a dramatic increment in the value of the stock market shift the AD curve? What effect would the shift have on the equilibrium level of GDP and the price level?

- Suppose Mexico, i of our largest trading partners and purchaser of a big quantity of our exports, goes into a recession. Use the AD/AS model to decide the probable touch on on our equilibrium GDP and price level.

- A policymaker claims that revenue enhancement cuts led the economy out of a recession. Can we use the Advert/As diagram to show this?

- Many financial analysts and economists eagerly await the press releases for the reports on the domicile price index and consumer confidence index. What would be the effects of a negative study on both of these? What about a positive written report?

Review Questions

- Name some factors that could crusade Advertising to shift, and say whether they would shift AD to the right or to the left.

- Would a shift of Advertizing to the right tend to make the equilibrium quantity and price level higher or lower? What most a shift of Advertizing to the left?

Critical Thinking Questions

- If households make up one's mind to save a larger portion of their income, what effect would this have on the output, employment, and toll level in the short run? What about the long run?

- If firms become more optimistic about the future of the economy and, at the same time, innovation in 3-D press makes most workers more than productive, what is the combined effect on output, employment, and the toll-level?

- If Congress cuts taxes at the same fourth dimension that businesses become more pessimistic near the economy, what is the combined effect on output, the toll level, and employment using the AD/Equally diagram?

Solutions

Answers to Self-Check Questions

- An increase in the value of the stock market would make individuals feel wealthier and thus more confident almost their economic situation. This would likely cause an increase in consumer confidence leading to an increase in consumer spending, shifting the AD curve to the correct. The result would exist an increase in the equilibrium level of Gdp and an increment in the price level.

- Since imports depend on GDP, if United mexican states goes into recession, its Gross domestic product declines and and then do its imports. This pass up in our exports tin be shown as a leftward shift in AD, leading to a decrease in our Gdp and price level.

- Tax cuts increment consumer and investment spending, depending on where the revenue enhancement cuts are targeted. This would shift AD to the correct, then if the tax cuts occurred when the economic system was in recession (and Gross domestic product was less than potential), the tax cuts would increment GDP and "lead the economy out of recession."

- A negative study on home prices would make consumers feel like the value of their homes, which for most Americans is a major portion of their wealth, has declined. A negative written report on consumer confidence would make consumers feel pessimistic about the future. Both of these would likely reduce consumer spending, shifting Advertizement to the left, reducing GDP and the cost level. A positive report on the domicile cost index or consumer confidence would practise the opposite.

Source: https://opentextbc.ca/principlesofeconomics/chapter/24-4-shifts-in-aggregate-demand/

0 Response to "A Rightward Shift in the Aggregate Demand Curve Can Be Caused by an Increase in:"

Post a Comment